In our recent Symanto Mood Index (SMI – created to map the consumer-mood) ranking we compared a number of brands across diverse industries and found (to our surprise) that Aldi came out on top, despite a relatively lower online engagement overall.

To understand what is driving this performance, we have used our homebuilt survey insight tool to benchmark Aldi against its fiercest competitor in the US Market “Lidl”. Over 4000 points of data were gathered from both companies official Facebook feeds for the month of April and using the tool we have extracted key insights that demonstrate how well consumers perceive each brand and, in particular given the timing, how they have navigated this global pandemic.

Not only did we find that the type of shopper is quite different but that Aldi’s response to the pandemic has been perceived more positively than Lidl. If you’re already too curious, jump down to the last chapter and see the conclusions we drew from our comparison. In case you want to know exactly how we got there and how you could operate such an analysis on your own, give our next sections a read and find out.

A Glimpse into the Brands’ Heartbeats

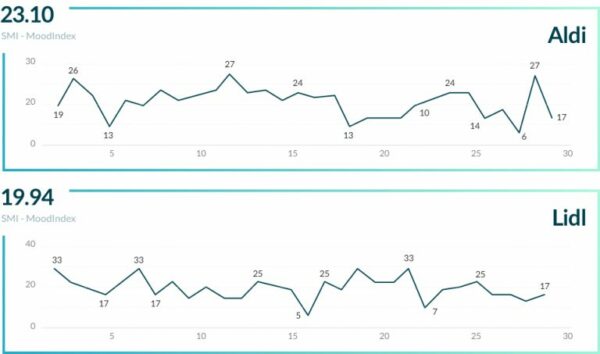

Once again, Aldi came out on top by 3 points with an SMI ranking of 23.10 compared to Lidl’s 19.94. To see what exactly was going on, let’s have a look at the two brands’ heartbeats over the past month.

Aldi experienced an early positive run on April 11th through which several social media users expressed their respect for the workers’ efforts and happiness with the stores’ cleanliness. However, the brand experienced a slump on April 28th when customers started voicing concerns about the face mask policy being implemented too late.

The same applies to Lidl’s drop on April 23rd where customers complained about a store in Hampton, Virginia being run poorly, or where employees in an Eatontown store didn’t follow proper hygiene and face mask policies. On the other side, Lidl’s positive spike on April 22nd was thanks to numerous users expressing their admiration for Lidl’s bakery products.

It seems the SMI hints that general concerns about hygiene and safety are those which drive negative developments in brand perception the most. Contrarily, in both cases it’s the employees who bear the potential to impact the brands’ reputations.

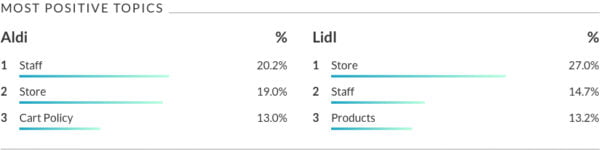

What’s driving the conversation?

Both the staff and the stores themselves were the topics that drove conversations the most. Whereas Aldi’s staff and stores have almost the same share of conversations, consumers talk more about Lidl stores than staff. Where it gets interesting is that whereas Lidl consumers then talk about specific products with the third highest percentage, there must be something with Aldi’s cart policy that polarizes in some way.

In the case of Aldi, the staff are recognized as great and amazing. Additionally, the term being mostly associated to the store itself is the feature “clean”, and the talking points about the carts are also mostly positive with customers being happy about sanitized and free shopping carts.

Lidl consumers really “love” the stores, however the term “clean” is not being articulated as frequently as it is with Aldi. The staff are recognized for being helpful and the products are mostly associated to the term “fresh”.

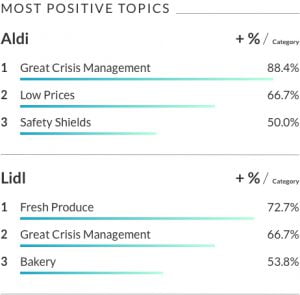

Crisis Management is Dominating Brand Perception

Now we need to ask ourselves, what contributes to the brands’ positive or negative brand perceptions the most. Both brands undeniably have good reputations for their good crisis handling skills, however where Aldi consumers articulate their love for low prices and praise the installing of safety shields for their employees, it is a different case for Lidl. Even during a global pandemic, two product groups are amongst the most positive topics: fresh produce section and the bakery, setting Lidl apart from Aldi and contributing to their positive recognition.

Consumers criticize Aldi for letting too many people into the store, poor usability of the Aldi mobile app, and a lack of cart wipes for the customers. On the other hand, people with preexisting conditions articulate concerns about Lidl’s measures like waiting in line. On top of that, consumers don’t trust the hygiene policies put in place such as one-way aisles, proper cart sanitization, and line management system inside the stores.

The Consumer Mix Matters

Because we got curious, we’ve applied our consumer profiling module onto the dataset as well, enabling us to identify the different consumer segments of a brand. We could identify rational consumers, whose actions are driven by judgement and reason, and emotional consumers, who judge on basis of their own feelings.

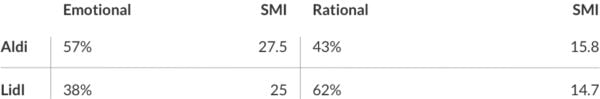

In both cases, it’s the emotional proportion of consumers that lift the mood around the brand. Lidl’s emotional segment is almost five points above the total SMI score, and emotional Aldi consumers score at 27.5, over four points above their total SMI. However, while Aldi has a higher percentage of emotional than rational consumers, the exact opposite applies for Lidl. In their case the percentage of emotional consumers is 38% compared to Aldi’s 57%.

Lidl has a higher margin (62%) of rational consumers than Aldi (43%), but in both cases the rational segment has a significantly lower score than the total rating. To better meet the needs of rational consumers, Lidl could improve by creating better working conditions for their staff, for example instilling hazard pay. What also comes to mind when reading through the negative comments about the staff, it seems that a lot of conflicts with in-store customers remain unsolved and people appear to wait in the queues quite long.

Additional transparency and execution of the hygiene policies should be enforced to better please the rational consumer segment.

While taking these potentials of improvement into consideration, one should note the points where Lidl is stronger than Aldi: fresh produce and bakery. These are key features that are already perceived as very positive. Communication and product portfolio in these two areas could be even more highlighted, focusing on the emotional consumer’s needs.

Both Brands are Doing a Great Job in Times like These

The analysis showed that the SMI rating gave interesting hints to follow down to a more granular level. What we saw were two German grocery discounters which settled into the competitive US market. Both are greatly appreciated by the consumers for their crisis handling skills and staff, but both also shine for their own specific reasons. While Aldi’s positive reputation is driven by the appearance of their stores and employees, it’s the price which is driving sentiment up as well.

The analysis showed that the SMI rating gave interesting hints to follow down to a more granular level. What we saw were two German grocery discounters which settled into the competitive US market. Both are greatly appreciated by the consumers for their crisis handling skills and staff, but both also shine for their own specific reasons. While Aldi’s positive reputation is driven by the appearance of their stores and employees, it’s the price which is driving sentiment up as well.

For Lidl, it is the product portfolio that excites their consumers. Not to forget, Lidl appears to be a brand with a significantly higher margin of rational consumers, who till now have not been wholly satisfied. In contrast, Aldi is a brand mostly driven by the very positive perception of their slightly larger emotional consumer segment. They also appear to do a better job with their rational consumer segment, even if it displays a smaller margin of consumers to them.

All in all, it can be said that both brands are doing a great job in times like these. It also turns out that brands which are not famous for having the largest online communities appear to have vital open discussions taking place on their social media profiles. We could even apply additional AI modules to extract insights on gender and age, but even with these comparably low efforts, the brands’ personalities begin to take shape.

If you’re interested in an investigation on your specific use case or any of our AI capabilities, feel free to reach out to us. We’ll be more than happy to walk you through our understanding of text analytics and the latest use cases of artificial intelligence.

Stay tuned for our upcoming comparisons.