Emerging reports reveal that mergers and acquisitions in the financial services market are at an all-time high. In 2021, the financial services M&A value stood at €22.6 billion. That compared with less than €2 billion just a year earlier, when there was an unexpected lack of M&A activity.

This coincided with a rise in neobanks (aka “challenger banks”) which offer a completely digital alternative to traditional banking services, and financial super-apps, which combine financial services with everyday lifestyle needs.

At the beginning of this year, Walmart announced that it is making two key acquisitions: US neobank ONE and financial benefits platform Even to form one single super-app. This app will be made available to Walmart’s 1.6 million employees and their 100 million+ weekly shoppers. 2022 may well be the year that financial super apps go mainstream.

In this fast-evolving market landscape, companies looking for M&A opportunities need to run quick and accurate due diligence and optimise their decision-making.

Using AI for Fast Investment Decisions

As a leader in natural language processing AI technology, we at Symanto have developed a tool to expedite the M&A due diligence process.

Symanto’s text analysis capabilities enable you to leverage Voice of Customer to get clear user feedback. Within minutes you can get a full report detailing ease of use, layout, customer services, expenses involved and much more from the perspective of the users themselves. Get further information about the customer base such as customer loyalty, net sentiment, and psychographic profiling.

Symanto technology is simple to use and understand and gives you deep insights into competing companies within minutes.

Neobank Case Study

Data source

Topic index

With Symanto you can choose from a variety of pre-existing use cases, or allow Symanto’s advanced text analysis to automatically identify key topics mentioned within conversations and reviews.

In this instance, the Symanto App use case measures five main topics and twenty-two sub-topics.

App attributes: app speed, compatibility, features/functions, general app, geolocation system, technical issues, UX/UI, content variety

Overall experience: brand perception, general experience, recommendation, trust/integrity

Service: approach, communication, general service, issue resolution

Process: account accessibility, account management, account security, setup/installation

Monetary: marketing/promotions, price

Net sentiment:

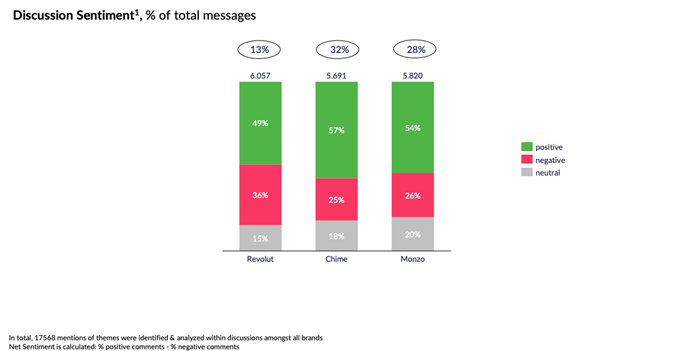

Symanto identified that Chime had the highest net sentiment score (32%) with 57% of topics identified within reviews measuring a positive sentiment.

Overall, Revolut received the lowest net sentiment score (13%) with 36% of topics identified within reviews measuring a negative sentiment.

Net sentiment drivers by brand and topic

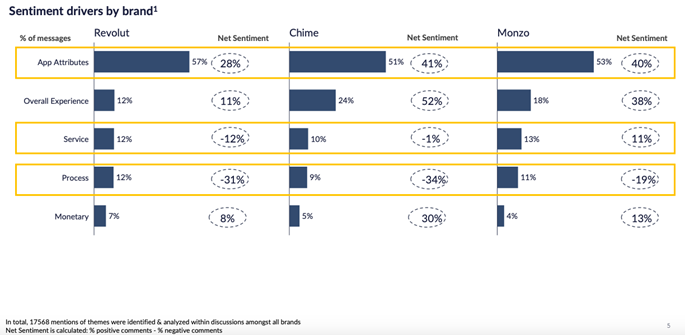

Delving deeper into Symanto’s insights, we see that App Attributes drive the majority of conversation, followed by Overall Experience.

All three neobanks received generally positive feedback for App Attributes, but we can see that Revolut has the lowest overall positive sentiment here.

Revolut scores lowest across the board with the exception of Process. Here, Chime scores the lowest, with a sentiment score -34%. Given Chime’s overall positive sentiment, it’s clear that Process is a key issue for them.

In terms of Service, Monzo is the outright winner at 11% compared to Revolut and Chime negative sentiment scores.

Net sentiment drivers by brand and subtopic

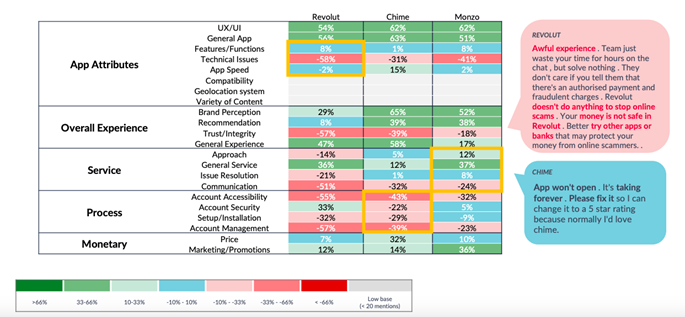

Further investigation reveals the subtopics driving sentiment by topic. We can see that Revolut’s main weakness is Technical Issues while it scores well regarding UX/UI and General App.

Here we can see the value of running like-for-like comparisons across competing apps. Take a look at general service. While Chime still performs positively overall, we can see that compared to Revolut and Monzo, it scores relatively poorly. Symanto makes it easy to benchmark performance to see how a company fares against industry standards.

We can also see in more detail how Chime’s users regard Process. Compared to Revolut and Monzo, Chime scores particularly poorly on Account Security. This is a major issue for a financial services app and could ultimately cost them a sizable portion of their customers.

Finally, looking at Service, Monzo is the best performer across the board, especially when it comes to its customer service approach and general service. Within this topic, communication seems to be the biggest issue for all three brands. Resolving this type of issue would enable these brands to a better customer retention and engagement.

Symanto also enables you to delve right down and read consumer reviews relating to each topic to find out exactly what users are saying.

Consumer psychographic segmentation

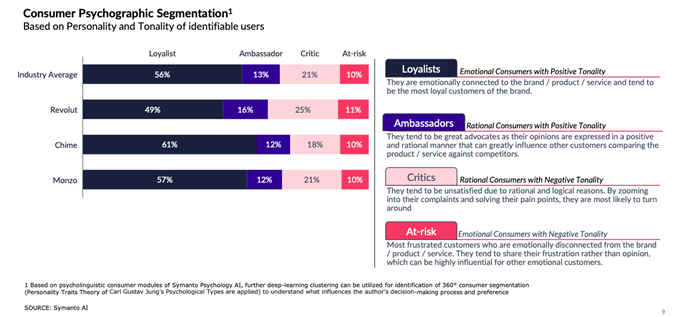

Symanto assesses tonality and emotions expressed within written text to give a psychographic overview of the apps users. Here you can find out what percentage of users are loyal (with a positive emotional connection to the brand) and which are at risk (with an emotional negative response to the brand.)

In this instance, all three brands have a relatively uniform customer base. It’s interesting to note the percentage of users with an emotional connection given the nature of the apps.

Get The Full Report

Get in touch to read our full report and find out more about the performance of each brand. Discover our alternative data visualisations to help you assess each brand individually and read our list of risks and opportunities for each brand – valuable information for financial services mergers and acquisitions.

If you’d like to run a similar report or if you’d like to know more about how to use Symanto for voice of customer due diligence for mergers and acquisitions, get in touch or book your free personalised demonstration.